Why Credit Restoration Is Not Usually Worth The Cost?

Why And When You Need A Credit Repair Attorney

If you've been trying to construct your credit report score, you may be thinking about employing a credit rating repair service to help. These business intend to develop your credit report by disputing obsolete or wrong info on your credit score reports, acting on outcomes and also monitoring to be certain errors do not reappear. Credit rating repair work can set you back around $100 a month as well as take several months with no guarantee that your credit history will be higher at the end.

Know exactly how your credit report is racked up, See your totally free score and the elements that affect it, plus insights into ways to maintain building. Is credit score fixing lawful? There are legitimate business offering credit report fixing solutions, however the field is likewise known for rip-offs, so it is essential to veterinarian any kind of firm you're taking into consideration employing - credit fixing services.

The Credit Report Fixing Organizations Act needs business to supply you a firm total on costs and a quote of how much time it will take to obtain outcomes. It also gives you three business days to cancel services without charge. A reliable firm needs to instructor you on how to handle your existing credit rating accounts in order to prevent further damages.

What can credit repair work solutions do? Genuine credit history repair solutions check your credit score records for details that shouldn't be there and contest it on your part. Many of them likewise inspect to be certain the details does not re-emerge. When details on your credit rating reports is challenged, credit report bureaus have 1 month to investigate.

Why And When You Need A Credit Repair Attorney

Insolvency or various other legal actions that aren't yours. Misspellings, which might mix in adverse entrances that belong to a person with a comparable name or may suggest favorable entrances aren't appearing when they should. Negative marks that are as well old to be consisted of. Exactly how a lot does credit scores repair work price? You pay a month-to-month fee to the credit score repair work service, typically from $69 to $149, and also the process might take a number of months to a year.

Credit repair services occasionally come in tiered plans, adding relevant solutions, such as credit rating monitoring or accessibility to credit rating scores, to the higher rates. Exactly how can I repair credit myself? Begin by inspecting your debt records from the three significant credit history reporting bureaus Experian, Equifax as well as Trans, Union by using .

Unverifiable details needs to be removed, although it may be renewed if it's confirmed later. An example may be a financial debt to a store that's now out of service; unless the merchant offered the financial obligation to a debt collector that can show ownership, it could be unverifiable. credit counseling services Las Vegas. Service your payment background.

Missed settlements can drag down your rating. Use much less of your offered credit score. Just how much of your readily available bank card restriction you're using is called your credit history utilization proportion. The lower it is, the much better for your score. If you can pay for to, think about making multiple small payments throughout the payment cycle, along with various other strategies to reduce credit rating use.

Missed settlements can drag down your rating. Use much less of your offered credit score. Just how much of your readily available bank card restriction you're using is called your credit history utilization proportion. The lower it is, the much better for your score. If you can pay for to, think about making multiple small payments throughout the payment cycle, along with various other strategies to reduce credit rating use.15 Best Credit Repair Companies: Raise Your Fico Score

Editorial Note: Credit scores Fate receives compensation from third-party advertisers, however that does not impact our editors' viewpoints. Our advertising and marketing partners don't evaluate, approve or recommend our editorial content - credit fix las vegas. It's exact to the most effective of our expertise when published. We assume it's important for you to understand how we generate income. It's quite straightforward, actually.

The cash we make aids us give you accessibility to complimentary credit history and also records as well as aids us develop our various other fantastic tools and also academic materials. Compensation may factor into just how as well as where products appear on our platform (and also in what order). However given that we typically generate income when you find an offer you such as and also obtain, we try to show you uses we believe are a great suit for you.

Obviously, the offers on our platform don't represent all monetary items out there, but our goal is to show you as many great alternatives as we can. If you have poor credit scores, you might be battling to get approved for a charge card, rent out a home and even get a personal financing.

Obviously, the offers on our platform don't represent all monetary items out there, but our goal is to show you as many great alternatives as we can. If you have poor credit scores, you might be battling to get approved for a charge card, rent out a home and even get a personal financing.These firms generally provide to assess your debt records and resolve any kind of adverse items that they can with the credit bureaus in your place. "It's not challenging to do many of these things on your own," states Bruce Mc, Clary, vice president of interactions at the National Foundation for Credit History Therapy.

Credit Reports And Scores

Servicing your credit score? A credit report repair business is an organization that offers to enhance your debt in exchange for a cost. The business usually guarantee to "handle all the heavy training" of collaborating with the credit score coverage agencies, states Mc, Clary. Debt fixing services are various from credit scores counseling agencies, which are typically a cost-free resource from not-for-profit financial education and learning companies that evaluate your financial resources, financial debt and also credit history reports with the objective of training you to enhance and also handle your financial situation.

To aid prevent scammers, it is essential to look into any credit history fixing company prior to consenting to work with it. There are "all kinds of methods" to veterinarian credit report repair service businesses, Mc, check it out Clary states. Below's someplace to start. Stay away from companies that seem also excellent to be real. If the company says it can do any of the complying with, it's a warning as well as likely an indication of a rip-off: Remove precise unfavorable info from your reports, Legally create a new credit scores identification for you, The firm requests you pay before it offers solutions, Guarantee boosted debt Once again, we suggest choosing a credit counselor first.

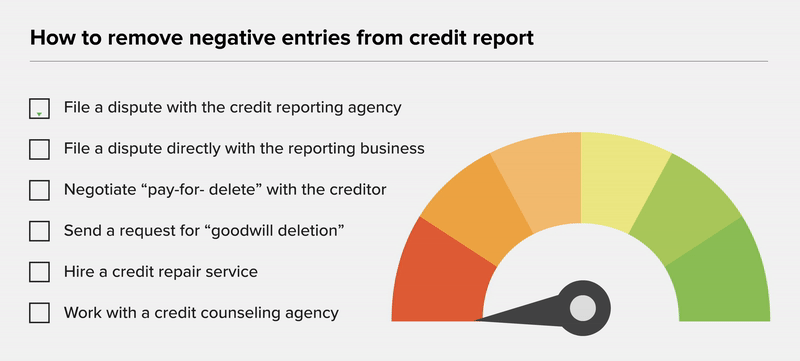

Lots of credit score repair work companies start by asking for a duplicate of your credit score record from each of the 3 major non-mortgage consumer debt bureaus Equifax, Experian as well as Trans, Union. The company will certainly assess your credit reports for negative marks, like Then, it will establish a prepare for disputing mistakes and also bargaining with creditors to get rid of those products.